How To Find Change In Gross Fixed Assets

Internet stock-still assets is a valuation metric that measures the cyberspace book value of all fixed avails on the residuum sheet at a given indicate in fourth dimension calculated by subtracting the accumulated depreciation from the historical cost of the assets. Yous can recollect of information technology equally the purchasing price of all stock-still assets such as equipment, buildings, vehicles, machinery, and leasehold improvements, less the accumulated depreciation.

Definition: What is Net Fixed Assets?

This metric calculates the remainder value of the assets. In other words, it theoretically calculates how much life or use these assets have left in them past comparing the full buy price with the total amount of depreciation that has been taken since the assets were purchased.

A low ratio can often mean that the assets are outdated because the company has not replaced them in a long time. In other words, the avails have loftier amounts of accumulated depreciation indicating their age.

Management typically does not apply this metric that much because they can simply examine their equipment and talk with the maintenance section to see if anything needs to exist replaced or repaired.

Investors, on the other hand, use this metric for a variety of different reasons. Net fixed assets helps investors predict when large hereafter purchases will be fabricated. It also helps them evaluate direction's efficiency using its assets.

The near common use of this financial metric is in mergers and acquisitions. When a company is analyzing possible acquisition candidates, they must analyze the avails and put a value on them. A small-scale internet corporeality relative to the total stock-still assets typically indicates that the assets are onetime and volition most probable demand to exist replaced soon and the acquiring company should value these assets accordingly.

Let's take a expect at how to calculate the net fixed assets equation.

Formula

The internet fixed asset formula is calculated past subtracting all accumulated depreciation and impairments from the total purchase toll and improvement cost of all fixed avails reported on the balance sheet.

Net Stock-still Avails = Total Fixed Avails – Accumulated Depreciation

This is a pretty simple equation with all of these assets are reported on the face up of the residue sheet. The fixed assets are by and large the tangible assets such as equipment, building, and machinery. Leasehold improvements are upgrades past an occupying tenant to leased building or space. Examples of leasehold improvements include cabinetry, lighting, walls too every bit new carpeting. Accumulated depreciation is the collective depreciation of whatever nugget or rather than it'south the total amount of depreciation cost detailed for an asset.

Many analysts take this net fixed asset equation a step further and remove liabilities for the net amount like this:

Net Fixed Avails = ( Total Fixed Asset Buy Price + Improvements ) – ( Accumulated Depreciation + Fixed Asset Liabilities )

The reasoning for removing the liabilities associated with the fixed assets is that now nosotros can see how much of the net avails the company actually owns.

Full liabilities are combined debts and all financial obligations payable by a visitor to individuals as well every bit other organizations at the precise flow.

Now allow'due south expand on this more than with an example.

Instance

Mexico Telecomm Visitor is looking to expand its operations in a new territory that is currently occupied by a competitor, Small Telephone. Rather than competing with another company MTC is trying to make up one's mind if it should buyout Small Telephone or not.

Since the utility industry is heavily dependent on fixed assets and equipment, MTC is interested in the condition of Small Telephone's assets. If these assets were in good status, MTC would not have to purchase all new equipment to service the new territory.

Looking in Pocket-size Telephone's balance sail, MTC notes the following line items.

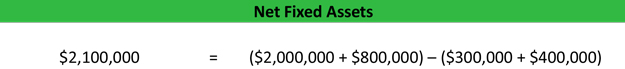

- Total stock-still assets: $2,000,000

- Leasehold improvements: $800,000

- Accumulated depreciation: $300,000

- Total liabilities on fixed avails: $400,000

Based on this available information, we tin calculate the net fixed assets using the above formula.

Internet fixed avails = ($2,000,000 + $800,000) – ($300,000 + $400,000) = $2,100,000

We can take this a step further and plow this into a ratio similar this:

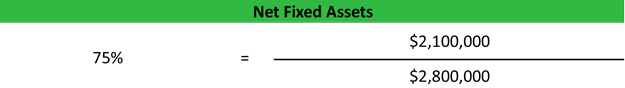

Net stock-still avails ratio = $ii,100,000 / $2,800,000 = .75

This metric and ratio shows usa that Pocket-size Telephone has only depreciated its assets 25% of their original cost. This typically ways that the assets are not old and should have plenty of use left in them.

Assay and Interpretation

The net fixed assets metric measures how depreciated and used a group of assets is. A higher NFA is always preferred to a lower NFA, equally it shows the assets are relatively newer and less depreciated. In the case above, nosotros can run across that Small Phone'southward avails are fairly new and theoretically withal accept 75% of their life.

This would be an idea conquering for MTC because information technology would accomplish two things. First, information technology would allow them to control another territory without having to struggle with new competition. Second, MTC wouldn't be required to purchase additional assets to service the new territory immediately.

If the purchase price is right and MTC does not accept underutilized avails at its current territory, this would be an platonic acquisition.

Investors can as well use this metric to gauge management'southward efficiency in using its assets. For example, if profits are at an all time high and the NFA is depression, management is running the company extremely well. It's maintaining loftier profits with older or outdated equipment. The opposite is also true.

Applied Usage Explanation: Cautions and Limitations

1 caution to keep in heed when using this metric is that accelerated depreciation can drastically skew this ratio and make it somewhat meaningless. For case, a company can buy a new piece of equipment and take SEC 179 depreciation for the entire buy in the year of the purchase. Thus, this brand new piece of equipment would have a internet book value of zero.

It'south of import to look at the tax to volume differences when analyzing this metric, as most accelerated depreciation schedules are acceptable for taxation purposes and not allowed by GAAP.

Also, but because an asset is depreciated doesn't mean it is worthless. Many avails outlive their useful lives 2-5 times over. A 100 year one-time edifice is a good example.

How To Find Change In Gross Fixed Assets,

Source: https://www.myaccountingcourse.com/financial-ratios/net-fixed-assets

Posted by: porterfrored.blogspot.com

0 Response to "How To Find Change In Gross Fixed Assets"

Post a Comment